In a remarkable financial achievement, Nvidia has surpassed Microsoft to become the world’s most valuable company. The chipmaker’s stock price surged by over 3% on Tuesday, propelling it to the top of the market valuation leaderboard and dethroning the tech giant Microsoft.

A Meteoric Rise in Stock Value

Nvidia’s share price increased by 3.5% to reach $135.58, resulting in a market capitalization surge of over $110 billion. This rally lifted the company’s total market value to an impressive $3.335 trillion. This remarkable growth came just days after Nvidia overtook Apple to become the second most valuable company in the world.

The company’s rapid ascent is even more astonishing considering its market value trajectory. In February, Nvidia’s market capitalization doubled from $1 trillion to $2 trillion within just nine months. By June, the company had hit the $3 trillion mark, taking a little over three months to add another trillion to its market cap. This rapid growth underscores Nvidia’s dominant position in the tech industry and its appeal to investors.

Impact on the Stock Market

Nvidia’s stock price rally has not only elevated its market position but also positively impacted broader stock indices. The surge in Nvidia’s stock contributed to the S&P 500 and Nasdaq reaching record highs. The company’s influence on these indices highlights its significant role in the stock market and the overall tech sector.

Moreover, Nvidia has become the most traded company on Wall Street by a considerable margin. Recent data from LSEG indicates that Nvidia’s daily trading turnover averages around $50 billion. In comparison, other tech heavyweights such as Apple, Microsoft, and Tesla have daily turnovers of approximately $10 billion each. Nvidia now accounts for about 16% of all trading in S&P 500 companies, emphasizing its pivotal role in the market.

Factors Driving Nvidia’s Success

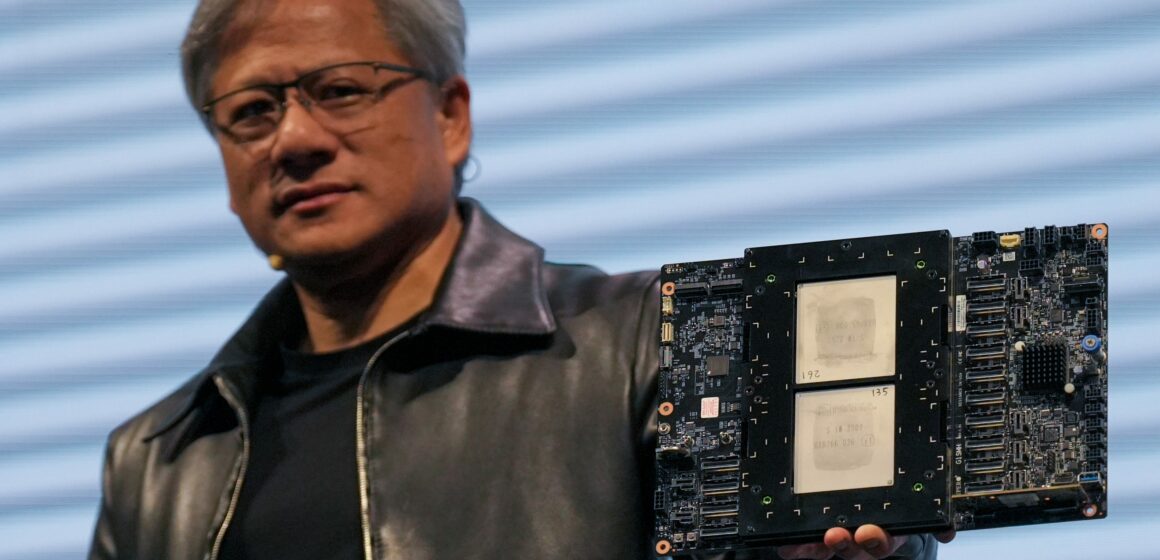

Several factors contribute to Nvidia’s meteoric rise. The company is a leader in the production of graphics processing units (GPUs) and has expanded its influence into artificial intelligence (AI) and data center markets. Nvidia’s GPUs are essential for AI applications, which are experiencing exponential growth. This demand for advanced computing capabilities has significantly boosted Nvidia’s revenue and stock value.

Additionally, Nvidia’s strategic investments and innovations in AI and machine learning technologies have positioned it at the forefront of the next wave of technological advancements. The company’s commitment to research and development ensures it remains a leader in the rapidly evolving tech landscape.

Future Prospects

Looking ahead, Nvidia’s prospects appear promising. The increasing adoption of AI across various industries, from autonomous vehicles to healthcare, presents substantial growth opportunities for the company. Nvidia’s continued focus on developing cutting-edge technologies will likely sustain its market leadership and drive further value creation for shareholders.

Moreover, Nvidia’s dominance in the semiconductor industry positions it well to capitalize on the ongoing digital transformation. As businesses and consumers increasingly rely on technology, the demand for Nvidia’s products and solutions is expected to remain robust.